With the wave of changes that are occurring in the healthcare industry, your lab needs to become leaner and more productive than ever to stay ahead. The most complex and significant of these changes stem from The Patient Protection and Affordable Care Act of 20101 and The Health Care and Education Reconciliation Act of 2010.2 They include:

- Fee schedule cuts

- Connectivity and patient access needed by providers and hospitals to meet Meaningful Use requirements

- Taxes on medical devices

- Regulations regarding payment and reporting

While these regulatory changes may seem insurmountable, there is a silver lining; some new developments will actually help your laboratory business. One of these includes an increased demand in genomic medicine. Patients suffering from cancer, heart disease, and other conditions are having better outcomes due to a variety of new genetic and molecular tests that identify the unique genetic profile of each patient and his or her disease. These tests, along with an aging baby boomer population in need of access to additional healthcare services, will result in higher volumes. Furthermore, there may soon be increased access to healthcare for millions of Americans thanks to the Patient Protection and Affordable Care Act (ACA). This act also includes provisions regarding free preventive laboratory screenings. As a result, the laboratory business landscape should thrive; the increased test volume potentially will offset fee cuts.

This article is intended to help laboratorians navigate the complex regulatory environment, providing clarity to the confusion surrounding the details of proposed, pending, and enacted legislation.

Changes to traditional service delivery models

With the increased presence3 of Patient Centered Medical Homes (PCMHs) and Accountable Care Organization (ACO) models, and as providers fall in line with the new reimbursement guidelines for patient outcomes rather than the traditional Fee for Service (FFS) model, many labs are reconsidering their current test volumes and payment arrangements. The new, value-based models are starting to gain traction. In fact, the Health Plan Readiness to Operationalize New Payment Models study determined that 82% of health plans consider payment reform a “major priority.” Nearly 60% forecast that more than half of their business will be supported by value-based payment models in the next five years.4

Both organizational models focus on reimbursement levels that are dependent on evidence-based reporting. Laboratory tests play a pivotal role in the diagnostic process and overall success of these treatment plans. Treatment plans resulting in improved patient outcomes, improved quality of care, and reduced costs will be rewarded. The ultimate impact on your laboratory is difficult to determine. It is certain, however, that multispecialty practices will collectively monitor patients’ laboratory results in a central database. This will lead to fewer duplicate tests, but it may also lead to higher volume as the laboratory serves a larger pool of physicians and patients.

Patient-Centered Medical Homes (PCMHs)

The Patient Centered Medical Home is a healthcare setting that facilitates partnerships among patients, their physicians, and patients’ families. This model focuses on the patient and the integration of all aspects of healthcare to improve physical and behavioral health, provide access to community-based social services, and enhance management of chronic conditions.

Two key areas required for the success of PCMHs are health information technology (HIT) and payment reform. Medical home services are typically offered from remote locations in the community. Therefore, a virtual network of providers and services must be available so information can be shared through electronic health record systems (EHRs). The new payment model promotes the delivery of preventive services and monitoring of chronic conditions based on improved outcomes, while stabilizing or reducing total healthcare costs. This model is typically used for Medicaid patients.

Accountable Care Organizations (ACOs)

An ACO is a healthcare organization whose goal is to tie provider reimbursements to quality metrics and reductions to the total cost of care for an assigned population of Medicare patients. The ACO may use a range of payment models (capitation, fee-for-service with shared savings, etc.).

CMS has established a Medicare Shared Savings Program (MSSP) to facilitate improvement in the quality of care for Medicare Fee for Service beneficiaries and reduce costs. In order to participate as an ACO, eligible providers, hospitals, and suppliers can work together to create a Shared Savings Program. The Shared Savings Program is designed to improve outcomes and increase value of care by:

- Promoting accountability for the care of Medicare Fee for Service (FFS) beneficiaries

- Requiring coordinated care for all services provided under Medicare FFS

- Encouraging investment in HIT infrastructure and redesigned care processes.

The MSSP will reward ACOs that lower their growth in healthcare costs while meeting performance standards for quality of care. Before being eligible to receive any bonus payments, an ACO must meet predefined scores with respect to 65 quality measures that are subdivided into five categories: patient/caregiver experience, care coordination, patient safety, preventive health, and at-risk population/frail elderly health.

Although the focus is on primary care, the proposed rule recognizes the benefits of reducing unnecessary repetition of laboratory testing and the monitoring of preventive wellness and chronic conditions. Having an in-house laboratory will allow for monitoring of patient tests associated with preventive care, as well as high-risk patients, and the monitoring of chronic diseases such as coronary heart disease, heart failure, and diabetes.

Changes due to legislation or regulation

We are living in a time when the federal rules governing reimbursement for laboratory services, and for healthcare services in general, are in a state of flux. In fact, that is probably the biggest understatement you’ll read this week. Here is a review of what has happened—or will happen, or might happen—that will affect clinical medical laboratories.

The medical device tax

One change that occurred on January 1, 2013, was the imposition of the medical device tax. The Patient Protection and Affordable Care Act levies a 2.3% excise tax on the sale and import of Class I, II, and III medical devices. According to the American Institute of CPAs, “The new law provides that any device defined in §201(h) of the Federal Food, Drug, & Cosmetic Act (FFDCA) that is intended for humans will be taxable. The FFDCA is written very broadly to include instruments, machines, implants, and invitro reagents, among others.”5 This new tax may not be on the books for much longer, however. On March 21, 2013, the U.S. Senate voted to pass a nonbinding budget amendment encouraging the repeal of the ACA’s medical device excise tax.

As it stands now, labs that purchase these devices are responsible for paying this tax because suppliers, manufactures, and distributors are likely to pass along these added expenses.6 If the tax is not repealed, it will exacerbate financial pressures the laboratory industry is already facing in the form of cuts to the Medicare Clinical Laboratory Fee Schedule.

Medicare fee schedule

Cuts to the Medicare fee schedule7 have been delayed for more than a decade. Recent events affecting the fee schedule are outlined below:

- The estimated impact to the physician’s fee schedule that was to go into effect on March 1, 2010, was -21.3%.8

- On March 3, 2010, Congress again delayed the enforcement of the conversion factor until April 1, 2010, with the passage of the Temporary Extension Act of 2010.9

- On April 15, 2010, Congress enacted the Continuing Extension Act of 2010 to again delay the implementation.10

- On June 25, 2010, President Obama signed the Preservation of Access to Care for Medicare Beneficiaries and Pension Relief Act of 2010, which delayed implementation of the conversion factor until December 1, 2010.

- On December 16, 2010, President Obama signed the Medicare and Medicaid Extenders Act of 2010 into law, delaying the implementation of the SGR until January 1, 2012.11 This prevented a 25% decrease in Medicare reimbursements from taking effect on January 1, 2011.

When President Obama signed the Middle Class Tax Relief and Job Creation Act of 2012 on February 22, 2012, the implementation of the conversion factor was again delayed until January 1, 2013, when the cut was estimated to be 27.4%.12 Congress passed the American Taxpayer Relief Act of 2012 on January 1, 2013, which states in section 601 that the conversion factor for 2013 “shall be zero percent.”13 This delays the implementation of the conversion factor until January 1, 2014, which will potentially be even bigger than 27.4%.

Under the administration’s present policy, physician pay rates would be frozen at their current level. The administration supports several years of fee for service payment stability that would give the Centers for Medicare & Medicaid Services more time to develop various pay-for-performance models from which physicians eventually could choose. The budget plan states the goal is to “provide predictable payments that incentivize quality and efficiency in a fiscally responsible way.” (Please see http://www.whitehouse.gov/sites/default/files/omb/budget/fy2014/assets/health.pdf for more detail.)

ICD-9 (soon to be ICD-10)

The ICD-9 diagnosis and procedure code sets will be transitioned to ICD-10 on October 1, 2014. That will be one of the largest changes to healthcare claim submission yet. There will be no transition period, so careful planning and extensive pre-launch training is critical. In order to prepare for this change, facilities should establish timelines as they work with vendors and partners to test and transition to the ICD-10 code set. A successful transition will ensure that they are able to use the ICD-10 codes by the deadline to help limit rejected claims and subsequent reduced cash flow.14

The ICD-10 code set is not a simple update of the ICD-9 code set. There are approximately 13,000 ICD-9 CM codes; there are approximately 68,000 ICD-10 CM codes. The transition to ICD-10 will not be easy for the healthcare industry. Laboratory information systems should provide tools to help the laboratory make it successfully. For example, if an ICD-9 code is entered when creating a requisition, the system should display the ICD-9 code with possible ICD-10 code matches so that the user can select from a list of suggested ICD-10 codes that link to the ICD-9 code entered. Figure 1 is an example of how technology can assist in managing these complex changes.

Patient access to test reports

On September 14, 2011, the Notice of Proposed Rulemaking titled “CLIA Program and HIPAA Privacy Rule; Patients’ Access to Test Reports”15 was published in the Federal Register. If this leads to comprehensive legislation, then more pressure will be placed on reference labs to be the primary vehicle to provide secure laboratory results directly to patients.

American Reinvestment & Recovery Act (HITECH ACT)

CMS grants an incentive payment to providers or hospitals who can demonstrate that they have adopted or deployed EHR technology. In order to encourage widespread EHR adoption, the HITECH Act rolled out “Meaningful Use” criteria as a phased approach, which is divided into three stages. (Editor’s note: For a related point of view on the topic of the staging of Meaningful Use, please see this issue’s “Washington Report,” page 64.)

While the funds are available only to providers and hospitals, most laboratories will still have a role in compliance. Measures that specifically affect the laboratory are Computerized Physician Order Entry (CPOE) and electronic test results. While orders were not a Core or Menu set objective in Stage 1, CPOE is a Core measure and requires a minimum of 30% (80% for Stage 3) of laboratory orders created by the provider in Stage 2. For results, a Menu set objective in Stage 1 required providers to incorporate a minimum of 40% lab results as structured data into their EHR. In Stage 2, electronic results incorporated into the EHR as structured data is now a Core objective, and the measure increased to a minimum of 55% (90% for Stage 3).

Affordable Care Act (ACA)

ACA has two key provisions that could have significant impact on increasing the volume of laboratory testing in the United States.

The first would significantly increase the number of low-income individuals with access to healthcare, starting in 2014. The ACA creates a minimum Medicaid income eligibility level across the country. Beginning in January 2014, individuals under 65 years of age with income below 133% of the federal poverty level will be eligible for Medicaid. Low-income adults without children will be guaranteed coverage through Medicaid in every state without need for a waiver, and parents of children will be eligible at a uniform income level across all states. Medicaid and Children’s Health Insurance Program (CHIP) eligibility and enrollment will be much simpler and will be coordinated with the newly created Affordable Insurance Exchanges.

According to the National Council for Community Behavioral Healthcare, the ACA includes a significant expansion of Medicaid to an estimated 16 million individuals.16

The second provision that should help boost the volume of laboratory testing is no-charge access for preventive laboratory services. The ACA has also required self-insured group health plans and health insurance issuers to cover preventive services without imposing co-pays or patient-associated cost-sharing obligations on enrollees.17 According to the Centers for Medicare and Medicaid Services (CMS), that includes preventive services in the form of medications, vaccines, assessments, and screening that are organized in specific age and gender categories for which coinsurance/deductibles are waived. For a list of covered laboratory Current Procedural Technology (CPT) codes, the American Medical Association has provided a CPT pocket guide.18

So in conclusion…

As Congress struggles to make critical decisions on balancing our budget, it is inevitable that laboratory services are affected. Healthcare costs in the United States are growing at an unsustainable rate, and many patients are covered by federally funded programs such as Medicare and Medical Assistance, and more patients will soon be added as a part of the ACA. This keeps the focus on cutting all areas of the fee schedule, which includes laboratory services.

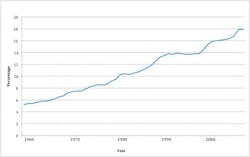

In fact (Figure 2), according to the Congressional Budget Office, “spending on healthcare will increase from 17% of GDP today to 25% in 2025 and 37% in 2050.”19

According to Kaiser, “health expenditures in the United States neared $2.6 trillion in 2010, more than ten times the $256 billion spent in 1980.20 Addressing this growing burden continues to be a major policy priority. Furthermore, the United States has been in a recession for much of the past decade, resulting in higher unemployment and lower incomes for many Americans. These conditions have put even more attention on health spending and affordability.”21

These conditions—and the regulatory and legislative developments that are part of the efforts to address them—are not going away anytime soon. Lab decision makers may feel overwhelmed by the extensive changes. However, it’s important to focus not only on compliance and reduced reimbursements, but also the incentive programs, new services, and models offering prevention services. There are many positive changes that may be beneficial to the clinical laboratory. Staying informed and taking the proper steps to prepare for these changes is critical to the success of any clinical laboratory facility.

References

- Senate bill – H.R. 3590. www.gpo.gov/fdsys/pkg/BILLS-111hr3590eas/pdf/BILLS-111hr3590eas.pdf. Accessed May 31, 2013.

- H.R. 4872. www.govtrack.us/congress/bills/111/hr4872/text. Accessed June 4, 2013.

- A report issued by Leavitt Partners, found that 221 accountable care organizations operated in 45 states as of the end of May, 2012. This represented a 35% increase from the 164 in 41 states identified in September 2011 in a report released Nov. 29, 2011, by the organization. www.cap.org/apps/docs/advocacy/aco/aco_proposed_analysis.pdf. Accessed June 4, 2013.

- Manos D. Value-based payment models expected to reach tipping point by 2018, study finds. Healthcare IT News. May 13, 2013. www.healthcareitnews.com/news/value-based-payment-models-expected-reach-tipping-point-2018-study-finds. Accessed June 4, 2013.

- Taxable medical devices are defined as any device “intended for use in the diagnosis of disease or other conditions, or in the cure, mitigation, treatment, or prevention of disease in man” Annette B. Smith. Preparing for the medical device excise tax. The Tax Advisor. July 1, 2012. www.aicpa.org/publications/taxadviser/2012/july/pages/clinic-story-03.aspx. Accessed June 4, 2013.

- Cohn M. Medical device makers shift excise tax cost to hospitals. Accounting Today. January 25, 2013. www.accountingtoday.com/news/Medical-Device-Makers-Shift-Excise-Tax-Cost-Hospitals-65455-1.html. Accessed June 4, 2013.

- Section 1848(f)2 of the Social Security Act specifies the formula for calculating the SGR. www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SustainableGRatesConFact/Downloads/sgr2013p.pdf.Accessed June 4, 2013.

- Sustainable Growth Rates & Conversion Factors. www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SustainableGRatesConFact/downloads/sgr2010f.pdf. Accessed June 4, 2013.

- Lillis M. On Health Care Reform, a Major Step Remains: Newly Passed Bill Doesn’t Address Medicare Payment Flaw. Washington Independent. March 24, 2010. http://washingtonindependent.com/80175/on-health-care-reform-a-major-step-remains. Accessed June 18, 2013.

- AMA. Final Medicare 2010 payment rule confirms deep cuts to physicians, puts seniors’ access to care at risk. October 30, 2009. www.ama-assn.org/ama/pub/news/news/medicare-2010-payment-rule.page. Accessed June 4, 2013.

- Associated Press. Obama signs bill to delay Medicare doctor pay cuts. Washington Post. December 15, 2010.

- Estimated sustainable growth rate and conversion factor, for medicare payments to physicians in 2012. www.cms.gov/Medicare/Medicare-Fee-for-Service-Payment/SustainableGRatesConFact/Downloads/sgr2013p.pdf

- Bill Text 112th Congress (2011-2012) H.R.8. EAS. January 2, 2013.

- CMS.gov. Centers for Medicare & Medicaid Services. www.cms.gov/Medicare/Coding/ICD10/ICD-10ImplementationTimelines.html. Accessed June 4, 2013.

- Federal Register / Vol. 76, No. 178 / September 14, 2011 / Proposed Rules www.gpo.gov/fdsys/pkg/FR-2011-09-14/pdf/2011-23525.pdf. Accessed June 4, 2013.

- National Council for Community Behavioral Healthcare (Updated 7/12/10). www.thenationalcouncil.org/galleries/policy-file/FAQs%20on%20Medicaid%20expansion.pdf. Accessed June 4, 2013.

- United States Department of Labor. http://webapps.dol.gov/FederalRegister/HtmlDisplay.aspx?DocId=25216&AgencyId=8&DocumentType=2. Accessed June 4, 2013.

- AMA. CPT Code Pocket Guide for Preventive Services. www.ama-assn.org/ama/pub/physician-resources/solutions-managing-your-practice/coding-billing-insurance/cpt/cpt-preventive-services.page Accessed June 4, 2013.

- Healthcare and GDP. www.phvg.org/Healthcare_and_GDP.html. Accessed June 4, 2013.

- Kaiser EDU.org. U.S. Health Care Costs. http://www.kaiseredu.org/Issue-Modules/US-Health-Care-Costs/Background-Brief.aspx. Accessed June 4, 2013.

- Kaiser EDU.org. U.S. Health Care Costs. www.kaiseredu.org/Issue-Modules/US-Health-Care-Costs/Background-Brief.aspx. Accessed June 4, 2013.