2025 molecular diagnostics state of the industry: Labs adapt amid shifting demand

The results of the 2025 MLO MDx State of the Industry Survey (SOI) are in! Over 100 medical laboratory professionals participated, answering questions on molecular diagnostics (MDx) testing modalities and trends, supply availability, and quality assurance.

New for this year, MLO queried the medical laboratory community on clinical areas driving MDx testing demand, proficiency testing for molecular assays, and the use of artificial intelligence/machine learning (AI/ML) tools for molecular diagnostics.

We present the quantitative survey results alongside commentary from medical laboratory professionals and vendors in the MDx space.

Key 2025 survey findings

- Clinical demand drivers: Infectious disease (non-COVID) dominates MDx testing demand, cited by 77% of respondents.

- Respiratory testing trends: More than half of laboratory professionals (55%) reported a 0–25% increase in respiratory testing this year, while nearly one-quarter (24%) reported a decrease (up from 17% in 2024).

- MDx modalities: rRT-qPCR remains the top MDx modality at 54%, though reported usage fell from 64% in 2024. Rapid molecular testing rose slightly to 52% (up from 49% in 2024), while rapid antigen testing decreased to 48% (down from 49% in 2024).

- AI/ML adoption: Two-thirds (67%) of labs are not using or planning to adopt AI/ML for molecular diagnostics. About one in five (19%) are considering future adoption, while 6% are already using AI/ML tools in their workflows.

- Supply chain pressures: Supply stability has improved: 71% of lab professionals report adequate supplies to meet demand (up from 62% in 2024), although there was a slight uptick in sourcing challenges for winged blood collection sets (16% vs. 13% in 2024). Quality Assurance: Proficiency testing participation is strong, led by The College of American Pathologists (CAP) (48%) and American Proficiency Institute (API) (36%). Labs are stepping up efforts to reduce the number of potential false positive test results, with 90% of respondents reporting they verify pre-analytical steps (vs. 68% in 2024).

Survey participants changed little since last year, with most respondents working in Lab Manager, Administrator, Supervisor, or Lab Director positions (53%), employed by hospital/health system labs (51%). One notable increase was participation in the survey by Medical Laboratory Scientists (MLS) (17% in 2025, up from 10% in 2024).

MDx testing volumes and trends

Most medical laboratory professionals surveyed (64%) report their labs performing between 0-100 molecular-based tests (non-COVID-19) per day.

Percentages for other volumes are as follows:

- 101-200: 13% (unchanged from 2024)

- 201-300: 6% (up from 5% in 2024)

- 301-400: 1% (unchanged from 2024)

- 401+: 17% (down from 22% in 2024)

When asked what types of molecular diagnostic tests they use most in their labs, reverse transcriptase quantitative polymerase chain reaction (rRT-qPCR) topped the list at 54% (down from 64% in 2024), followed by rapid molecular tests at 52% (up from 49% in 2024), and rapid antigen tests at 48% (down from 49% in 2024).

Responses for the other testing MDx modalities:

- Flow cytometry: 14% (down from 21% in 2024)

- DNA/genetic testing: 11% (down from 20% in 2024)

- Next generation sequencing: 10% (down from 18% in 2024)

- Mass spectrometry: 9% (up from 8% in 2024)

- Reverse transcription loop-mediated isothermal amplification (RT-LAMP): 8% (down from 9% in 2024)

- Recombinase polymerase amplification (RPA): 6% (up from 4% in 2024)

- Liquid biopsy: 7% (up from 6% in 2024)

- None: 5% (up from 3% in 2024)

- CRISPR-based diagnostics: 2% (up from 0% in 2024)

Additionally, 5% of respondents selected “other” as a response (down from 11% in 2024), offering up these alternative testing modalities used in their labs: Lab developed tests (LDT), PCR amplification, multiplex real-time RT-PCR, and qPCR.

“At times we are asked to look into new assays or procedures,” said George Manolopoulos, Clinical Lab Manager, Pathology Reference Lab in San Antonio. “The FDA regulation of LDTs would have been an issue if it stayed in place. A decision had been made not to look into any new LDT implementation as we didn’t have the resources or wanted to deal with an FDA submission. Nevertheless, without the FDA regulation in mind our decisions are driven solely by client demand and as such we haven’t implemented any new molecular methodology since 2020.”

Matt Easterday, CEO, Dovetail Genomics, spoke to how advances in 3D genome architecture are helping researchers uncover functional disease variants that traditional linear sequencing often misses:

“Traditional sequencing shows us the linear code of DNA, but much of disease biology lies in how that code folds and interacts in three-dimensional space. By mapping genome architecture, researchers can pinpoint structural variants, enhancer hijacking, and other regulatory events that drive disease yet remain invisible to conventional approaches.

“At Dovetail Genomics, our LinkPrep platform integrates sequence and structure into a single workflow, enabling labs to uncover clinically relevant variants at higher sensitivity and with clearer biological context. These insights are proving especially valuable in oncology, where understanding 3D genome organization can reveal functional variants linked to disease progression, relapse, and therapeutic resistance.”

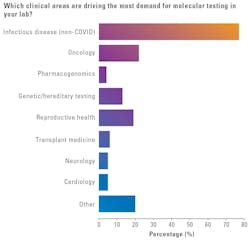

Clinical demand

New for this year, MLO asked medical laboratory professionals which clinical areas were driving the most demand for molecular testing in their labs. Over three-quarters of respondents (77%) cited infectious disease (non-COVID) as driving the greatest demand.

About one-fifth of respondents reported oncology (22%) or reproductive health (19%) as driving the most demand for MDx.

As for other clinical categories:

- Genetic/heredity testing: 13%

- Transplant medicine: 6%

- Neurology: 5%

- Cardiology: 5%

- Pharmacogenomics: 4%

An additional 20% of respondents cited another clinical area responsible for molecular testing demand, with the top categories including:

- Emergency department

- Environmental/activities of daily living

- Gynecology

- Pediatrics

- Primary care/family practice

- Pulmonology

- Sexually transmitted diseases (STD)/sexually transmitted infections (STI)

- Stool microbiome

- Urgent care

- Urology

Antonio Vergara, senior vice president, Core Lab and Near Patient Care at Roche Diagnostics, commented on clinical lab trends and technology adoption, stating:

“Clinical laboratories are navigating a dynamic molecular diagnostics landscape, marked by a shift from high-volume, single-target assays toward comprehensive, customizable syndromic testing. This evolution, driven by the need for faster, broader answers in areas like respiratory and sexual health, is coupled with ongoing lab consolidation, reimbursement dynamics, and greater workflow efficiency.

“As test-to-treat remains ever important, laboratories are demanding faster and more expansive testing capabilities, adaptable for seasonality, patient population and care setting. Roche is directly addressing these challenges with flexible and automated solutions. Our recently 510(k) cleared cobas Respiratory 4-flex empowers labs to customize panels for specific testing needs on the cobas 5800/6800/8800 molecular systems.

“Technology adoption is also accelerating, with next-generation sequencing (NGS) and digital PCR becoming more prevalent for high-throughput and sensitive analysis. Roche's sequencing by expansion (SBX) technology, currently in development, will provide a novel, cost-effective option for high-throughput analysis for research projects.”

Yves Dubaquie, senior vice president, Diagnostics, Revvity, spoke to the need for MDx testing that meets the broad demand for efficiency, accuracy, and access. He stated:

“Clinical laboratories are rapidly adopting COVID-era innovations—such as self-sample collection, decentralized testing, and rapid nucleic acid diagnostics—to accelerate same-day treatment decisions and expand patient access. This shift reflects a broader need for solutions that are not only faster and more accurate, but also practical and scalable across diverse healthcare settings, including low-resource and low-income regions where the burden of infectious disease remains highest.

“Revvity is supporting this transformation with innovations that directly address these evolving needs. Through streamlined workflows like the automated T-SPOT.TB test, Revvity helps laboratories simplify complex processes, reduce turnaround times, and improve consistency in results.”

Meghan W. Starolis, MS, PhD, HCLD(ABB), Senior Science Director, Infectious Disease at Quest Diagnostics, noted the trend of patients taking a more active role in their own healthcare, specifically around testing for human papillomavirus (HPV) and STIs.

“Consumers are increasingly seeking solutions that meet their needs in an evolving healthcare landscape, and we expect to continue seeing a demand for greater patient empowerment,” said Starolis. “Self-collection is something many more patients are taking an interest in, particularly for certain women’s health testing such as for HPV or STIs.

“The ability for a patient to self-collect has many advantages, like increased patient comfort and convenience. Offering self-collection for HPV primary screening has the potential to significantly increase the number of patients screened and get the care they need to prevent or treat cervical cancer. But one potential challenge as we move forward in this space, is ensuring that patients who do need follow-up care following HPV testing, such as pap smears or colposcopies, are appropriately linked to that follow-up care.”

Respiratory testing

When asked how much respiratory testing has increased in their labs since last year, the most notable response was among those reporting it had decreased, at 24% of respondents, up from 17% in 2024.

As for those reporting an increase in respiratory testing:

- 0-25% increase: 55% (up from 49% in 2024)

- 26-50% increase: 13% (down from 20% in 2024)

- 51-75% increase: 6% (unchanged from 2024)

- 76-100%: 1% (down from 7% in 2024)

- 101+% increase: 1% (up from 0% in 2024)

“There is a slow but steady growth in MDx testing volumes in areas that have always been the staple of our lab,” Manolopoulos commented. “On the contrary, respiratory testing, i.e. COVID testing, has ceased. Since there are plenty of options for clinicians’ offices for that type of testing, our lab has refrained from expanding in that area.”

“Respiratory molecular diagnostic testing has ebbed and flowed post-COVID, and not just seasonally,” said Sheridan M. Voshake, MS, MLS(ASCP)cm, Medical Laboratory Supervisor, Memorial Hospital, Carthage, Il. “While it still tends to spike in the winter months, we have also seen where it will sporadically increase during other times of the year depending on whether there is a regional outbreak occurring.”

“We have removed stand-alone COVID molecular testing and huge panels with non-clinically significant multiple targets as readily available, and now only offer it as a four-plex with Flu A/B and RSV,” Voshake added. “I believe that drilled-down panels, like the four-plex, are an appropriate middle ground between guessing at single target molecular testing and not getting reimbursed on big panels with too many clinically insignificant targets.”

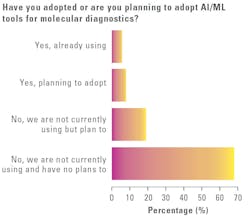

AI/ML trends

With increased attention on the use of AI/ML in healthcare, including the lab environment, MLO asked medical laboratory professionals if their labs had adopted or are planning to adopt AI/ML tools for molecular diagnostics.

Most survey respondents (67%) reported their labs are not currently using AI/ML, nor do they have plans to, nearly one-fifth (19%) said they are not currently using these technologies but plan to use them, 8% said they are planning to adopt them, and 6% said they are already using them.

Eunsin Bae, M.D., Sr. Vice President/Head of Global Communications, Seegene, commented on the need for automation in medical laboratories, stating:

“Seegene views the major trend in clinical laboratories as the need for solutions that maximize efficiency while reducing costs and reliance on limited resources. Laboratories are under pressure to deliver rapid, accurate results despite workforce and budget challenges, and scalable technologies are becoming essential. Seegene supports this shift by providing fully automated platforms and multiplex assays that streamline the entire diagnostic process from sample to result, helping laboratories strengthen operational sustainability and expand access to high-quality diagnostics worldwide.”

Supply chain trends

Nearly three-quarters of medical laboratory professionals (71%) reported having adequate testing supplies to meet testing demands (up from 62% in 2024). Conversely, 29% reported that a lack of sample-related products has impeded their testing capacity at times (down from 38% in 2024).

Delving into specific supply categories where they have experienced trouble sourcing due to supply chain issues, half of participants (50%) reported having no problem in any of the categories MLO offered as potential survey answers, up from 36% in 2024.

Commenting on improved supply chain conditions, Manolopoulos stated: “Since the peak of COVID, supply chain issues and availability of assay reagents have improved dramatically. It has been a couple of years since a needed item was delayed or on back order.”

The one supply category where there was an increase in reported sourcing issues was winged blood collection sets at 16% of respondents, up from 13% in 2024. In all others, medical laboratory professionals reported fewer sourcing problems compared with last year.

- Controls/Reagents: 22%, down from 27% in 2024

- Blood collection tubes: 17%, down from 26% in 2024

- Culture media: 8%, down from 21% in 2024

- Pipettes/pipette tips: 8%, down from 11%

- Testing kits for SARS-CoV-2: 8%, down from 11% in 2024

- PPE: 3%, down from 7% in 2024

- Swabs/Consumables: 7%, down from 10% in 2024

- Blood culture transfer devices: 3%, down from 8% in 2024

- Transport media: 1%, down from 10% in 2024

- Urine testing supplies: 1%, down from 3% in 2024

- Lab plastics not noted above: 12%, down from 16% in 2024

As for respondents who indicated they were experiencing sourcing issues in other product categories (3%, down from 4% in 2024), contributed answers to the question included needle holders that have the safety cap attached and polymerase chain reaction (PCR) kits.

Jennifer Schneiders, Ph.D., president, Diagnostic Solutions at Hologic, commented on how clinical laboratories are navigating workforce shortages and supply chain challenges while facing growing demand for faster, more accurate molecular diagnostics. She stated:

“This drives the need for automation and integrated platforms that increase throughput without compromising quality. By partnering with labs, we focus on delivering scalable solutions, like Hologic’s Panther System, a fully automated molecular diagnostics platform that enables the consolidation of a growing menu of assays for women’s health, sexually transmitted infections, respiratory infections and more. Through ongoing training, and with our combined expertise, we help labs streamline workflows and uphold the rigorous quality standards we all expect. Our commitment is to invest in the labs of the future and help them expand access to diagnostics that enhance patient care through early, accurate detection.”

Quality assurance

Another new question for this year was around proficiency testing for molecular assays. MLO asked if their labs participate in this testing, and if so, through what organization do they participate. CAP was highest on the list at 48% of respondents, followed by API at 36%, WSLH Proficiency Testing at 6% and the Centers for Disease Control and Prevention (CDC) at 3%.

One-fifth of respondents (20%) said their labs do not participate in proficiency testing for molecular assays. Additionally, 7% of respondents who reported their labs participate in proficiency testing for molecular assays said they did so through another source. Sources cited include:

- A blinded internal PT as it is unique LDT

- Alternative assessment procedures

- CMC Vellore EQAS

- controllab (Brasil)

- PEEC (Chile)

- QCMD

- RfB

- RML

When asked how they handle questionable results with molecular tests, half of medical laboratory professionals report repeating the test (50%, up from 45% in 2024).

The other modalities reported are as follows by percentage ranking:

- 22% verify that all pre-analytical, analytical, and/or post-analytical steps are performed correctly (down from 24% in 2024)

- 16% repeat the test with a different employee/equipment/test (up from 15% in 2024)

- 4% send results to another lab for verification and second test (down from 6% in 2024)

Among the 7% who selected “other” as their response, most noted they use all the modalities listed.

Regarding steps taken to reduce the number of potential false positive test results, those surveyed reported greater use across all methodologies proposed compared with last year.

- 90% verify all pre-analysis steps are performed correctly (up from 68% in 2024)

- 67% decontaminate the work/test area per laboratory procedures (up from 59% in 2024)

- 62% repeat the test with the same sample and new extractions (up from 47% in 2024)

- 39% refer to quality assurance program (up from 34% in 2024)

- 30% repeat the test with another method and compare results (up from 14% in 2024)

A further 6% medical laboratory professionals reported that they don’t use any of these methodologies to reduce the number of potential false positive MDx test results (up from 3% in 2024), and 7% said they use another method not specified in the survey (unchanged from 2024).

Other methodologies cited by survey respondents:

- Get a new swab

- Make sure staff is well trained in all areas of molecular testing

- Monitor positivity rates

- Recollect sample and repeat test

Conclusion

The 2025 MLO MDx State of the Industry Survey paints a picture of laboratories that are adapting to evolving testing demands while strengthening supply resilience and quality safeguards.

Infectious disease testing continues to drive the majority of molecular work, even as respiratory testing levels off and emerging modalities make small but meaningful gains. While adoption of AI/ML remains limited, labs are proactively refining practices to reduce false positives and ensure test reliability.

Together, these findings highlight a sector that is cautiously innovating while holding fast to its core mission: Delivering accurate, timely, and high-quality molecular diagnostics to support patient care.

About the Author

Kara Nadeau

has 20+ years of experience as a healthcare/medical/technology writer, having served medical device and pharmaceutical manufacturers, healthcare facilities, software and service providers, non-profit organizations and industry associations.