Smart steps for labs and hospital outreach as CMS prepares to cut Medicare fees

One of the first lessons I learned in business was that “pigs get fat; hogs get slaughtered,” with the idea being that too much greed can be a bad thing. In that context, I believe that the business strategy employed by the nation’s largest commercial laboratories to aggressively negotiate steep discounts on their clinical laboratory fee schedules to gain market share will result in driving the most disruptive change to Medicare’s Clinical Laboratory Fee Schedule (CLFS) in more than 20 years. Beginning in January 2018, Medicare’s payment rates (under the CLFS) will use private payer rates to set CLFS rates, which are projected to be 20 percent to 30 percent less than the current CLFS rates.

In 1984, the Centers for Medicare and Medicaid Services (CMS) established the CLFS, which was based on cost data at the time. Since then, lab test rates have been adjusted annually for inflation and, for the most part, market changes and innovation in the laboratory (technology, private payer rates, etc.) were ignored—until a study in 2013 showed that CMS was paying 20 percent more than private payers. This data led to legislation under the Protecting Access to Medicare Act (PAMA) of 2014, which requires, among other things, applicable laboratories to report private payer reimbursement rates for individual tests. Private payer data will subsequently be used to set future Medicare payment rates, which is expected to result in a reduction in Medicare lab payments by $3.9 billion over the next 10 years.1 The decline in payments for clinical lab tests will have an impact on all laboratories, including hospital, commercial, and physician office-based laboratories.

Drivers of PAMA

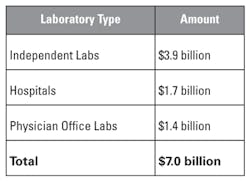

Since its introduction, there have been many questions as to what drove PAMA legislation and how to accurately anticipate and proactively mitigate the potential impact. The origin of PAMA dates back to Office of Inspector General (OIG) studies conducted in 2010 and 2013, which showed that Medicare paid between 18 percent and 30 percent more than private payers for 25 high-volume and/or high-expenditure laboratory tests.1 These 25 highest-volume, highly-automated tests make up 59 percent, or approximately $4.1 billion dollars, that Medicare paid out of the total $7 billion in 2015 alone.2 The payments break down as shown in Table 1.2

Two key factors affected private payer rates being less than the existing

Medicare reimbursement rate:

- Aggressive discounting of rates by commercial laboratories with private payers in an effort to grow market share.

- The ability of health plans to negotiate lower payment rates for new commercial laboratories entering the space, all of whom lacked leverage to aggressively negotiate more favorable rates.

Key payment, reporting, and fee schedule changes

Under Medicare payment reform, updated rates will be determined based on new reporting requirements. “Applicable laboratories” as defined by CLIA will need to report data on private payer rates if they have a unique national provider identifier (NPI), receive greater than 50 percent of all Medicare revenue from the CLFS, and received at least $12,500 in Medicare revenues from laboratory services on the CLFS. These applicable laboratories will need to report the test volume that corresponds to each private payer rate for specific CPT codes associated with each test for the six-month period of January 2016 through June 2016. Out-of-network, non-contracted work for private insurers as well as patient deductibles and coinsurance will be included in the private payer rate. Exclusions that will not require reporting fall into four key categories: capitated payments, partial payments, denied claims, and claim-level payments.

Moving forward, migration to one national fee schedule is planned. CMS will calculate the weighted median private payer rate for each test and set rates accordingly. Most hospital-based labs will be excluded unless they maintain a separate NPI for the laboratory and meet the revenue-based thresholds. Estimates from CMS indicate that 56 percent of independent laboratories, 95 percent of physician laboratories, and the majority of hospital-based laboratories will not meet the definition. The omission of hospital private payer rates from the reporting group has a negative impact on the market data as hospitals are typically paid 20 percent to 30 percent more than independent laboratories. As such, the exclusion of the majority of hospital-based labs skews the data in favor of a lower private payer weighted median and, therefore, a lower rate per the CLFS. New rates will include the weighted median of private payer rates/test volume and be updated on a three-year rotation. Beginning in 2018, a phase-in approach for reductions will be implemented, with limits on reductions for each test by a maximum of 10 percent through 2020 and 15 percent from 2021 to 2023.

The impact of PAMA legislation

What is the estimated impact that PAMA will have on providers in the clinical laboratory segment? Using the total spend of $7.0 billion in Table 1, hospital-based laboratory reimbursement is expected to decline by approximately $0.9 billion over the next five years, while independent and physician office laboratory reimbursement is expected to decline $2.7 billion over the same time period.3 Perhaps the only good news is that rates are likely to stabilize once all initial reductions have been implemented.

Chi Solutions, Inc. (an Accumen company), has done several case studies based upon the size, payer mix, type of hospital-based outreach programs, and cost allocation structure. Based on these studies, large hospital outpatient laboratories will face a significant loss of revenue but due to size and scale will be better equipped to absorb the loss. Smaller hospital-based laboratories, physician office laboratories, and commercial laboratories that have a high Medicare population are at potential business risk as the reimbursement reductions will have a severe impact on their bottom line.

Proactively mitigating pending cuts

Assessing the impact of pending reimbursement cuts on your organization is critical. In addition to PAMA, price transparency, value-based care, test utilization, and population health are expected to put additional revenue pressures on clinical laboratory service providers. The best long-term solution is a global laboratory strategy that encompasses cost reductions, outreach growth, test utilization, quality and service improvements, and improvements to information technology.

Important strategies to consider to offset reimbursement reductions include standardization of equipment and reagents, maximizing synergies from consolidation, growing the laboratory outreach program, managing reference lab and blood costs, and applying lean practices as necessary. Moving from a passive to a proactive response will require hospitals and health systems to look beyond common reactions to change when it comes to their outreach programs.

The most successful approaches include strategic price transparency, development of tools to manage the business (such as distinct accounting and financial reporting for the laboratory), strategic alignment with clients, development of sales with professional staff, outsourcing billing, aggressive cost-reduction initiatives, and a “for-profit” approach that includes the structure and autonomy to run as a serious business. Those are just a few options to explore. To achieve best-in-class performance, there is no magic formula. It simply requires doing a lot of things right. Keep in mind that 20 percent of the things that you do right will impact 80 percent of the opportunity for improvement and better performance.

REFERENCES

- Medicare Payments for Clinical Laboratory Tests in 2015, Office of Inspector General HHS OIG Data Brief, September 2016.

- Medicare Payments for Clinical Diagnostic Laboratory Tests in 2015, Year 2 of Baseline Data, Office of Inspector General HHS OIG Data Brief, September 2016.

- Calculated using data from Table 14, Federal Register “Final Rule,” June 23, 2016

Jeffrey H. Myers, CPA, serves as Vice President of Consulting for Accumen Inc., and its subsidiary Chi Solutions, Inc., providers of clinical laboratory consulting, outreach, comprehensive patient blood management (cPBM), and laboratory excellence solutions for hospitals and health systems.