For busy clinical labs, IT solutions present an opportunity to achieve consistent, accurate test results that are industry-standardized and reproducible. As a byproduct of using IT in the lab, daily workflow requirements become more efficient and effective with staff more productive. Using IT in the lab has also shown to be cost-effective and budget-friendly for labs that have taken advantage of the benefits that IT solutions offer, such as data organization and streamlined workflow.

In an effort to learn more about how today’s clinical labs are using IT solutions, Medical Laboratory Observer (MLO) invited subscribers to respond to a 16-question survey, giving their feedback. In the end, almost 300 people responded, and data the survey collected showed that IT usage in the clinical lab is far from just a temporary trend. Rather, it’s a valid and time-saving choice – one whose acceptance and implementation is growing every day, suggesting it will be an asset to clinical labs long into the future.

Demographics detail respondent roles

To better understand the demographics of survey respondents, MLO asked everyone who completed the survey to list the title they currently hold. Of the 273 survey respondents, more than half (53 percent) are in lab management positions (administration, supervisor, manager or director). Another 31 percent of respondents are medical lab scientists/technicians (MLS/MLT), section managers/department heads and clinical lab scientists/technicians (CLS/CLT). The remaining 16 percent of survey respondent hold positions in compliance, QA/QC, education, POCC/POCT, pathology, LIS/EMR/EHR, IT, nursing, blood banking, regulatory affairs and consulting.

Survey respondents were also asked what type of organization best describes their lab, with hospital lab accounting for 68 percent of submitted answers. Of theWithin these labs and lab-related companies, the majority of survey respondents (44 percent) indicated their staff consists of up to 25 people, while another 20 percent of respondents noted their lab staff includes 26-50 people. Larger labs with 51-100 people on staff were represented by 17 percent of survey respondents, and the remaining 19 percent of labs reported more than 100 people on staff.

Factors affecting IT usage in clinical labs

According to clinical laboratory personnel shortage statistics reported by the American Society for Clinical Laboratory Science (ASCLS), clinical labs in the U.S. perform over 4 billion tests each year. Consider that many of these tests are being performed in clinical labs with declining resources – such as enough staff to meet testing demands – and the need for assistance becomes even more evident (https://www.ascls.org/advocacy-issues/workforce).

As such, the greatest appeal of IT is that it offers the needed assistance by way of software solutions that are designed to streamline lab workflows—increasing the accuracy of test results and overall productivity, while simultaneously reducing the risk of hands-on human errors. Yet, there are still labs that have not embraced the use of IT for a variety of reasons.

One of the biggest obstacles for installing and integrating an IT solutions system is usually the age and size of the existing lab/facility’s infrastructure. For smaller, low-volume labs, the cost to replace existing infrastructure with new systems—assuming the new system would take up the same amount of space and not require more—has traditionally kept the idea out of financial reach. On the other hand, larger labs are prime candidates for using IT solutions simply because their demands are greater, their staff is bigger and the chances of seeing a successful return on investment (ROI) are also better, for the most part.

As part of the IT survey, respondents were asked to reveal current or changing factors that have affected their use or adoption of technology in their labs. The most common answer was new testing abilities, followed by an almost-equal number of respondents whose answer was state or federal regulatory changes. These choices were followed by reimbursement changes and patient demographic changes as the most popular answers. Among the write-in “other”When asked how many staff members already use processes that incorporate IT such as laptops, desktops and automation equipment, 48 percent of respondents indicated up to 25 people. Among the rest of the respondents, 19 percent indicated 26-50 of their staff uses IT, along with 16 percent who have 51-100 people using IT and 17 percent of respondents who noted over 100 people use IT in their labs.

The importance of LIS/LIMS

In consideration of the huge amount of data generated by clinical labs, there is an overwhelming need for a place to house it all and organize it until it’s needed. This is where labs can benefit from having LIS/LIMS systems in place – to ensure notWithin the IT survey, respondents were asked how they currently use their LIS and 95 percent reported that they use it for electronic orders and results. Encouraged to select all answers that apply, respondents also chose clinical data connectivity as the second most popular answer, followed in importance by less manual intervention, customer service and scheduling. Additional answers from respondents included planning and inventory optimization, sales revenue, improved forecast accuracy, quality review and report generation.

Respondents also listed their top priority when considering informatics including LIS (a lab information system intended to store and track patient data) and LIMS (also for information storage, but specifically designed for sample management). Among the five answer choices offered, the most frequently chosen was analyticWhen asked what they felt was the most important reason was to invest in a LIS/LIMS, respondents were in agreement with their answers, which were increased patient safety, improved workflow, data integrity, security and scalability, as well as total connectivity. Other choices listed were maximized reimbursements and advanced reporting.

Budgets for IT and questions about analytics

Behind the doors of any clinical lab, certain conversations tend to be repeated over and over. These conversations usually begin and end with the same word: budget. For example, when a lab director asks for more staff they may be told there is no budget for it. Clinical labs are expected to produce reliable data under increased pressure and time constraints from clinicians who are eager to begin patient treatment once they have test results in hand. At times, it may seem like the biggest obstacle in patient care.

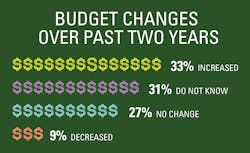

But there is some good news reported by way of survey respondents, with 33 percent admitting that their budgets have increased compared to two years ago. Another 28 percent said their budgets stayed the same, and 29 percent did not know if their budget had changed from two years ago. Only 9 percent of respondents

noted that their lab budgets had decreased from two years ago, with the remaining 1 percent revealing that they are not privy to budget-related information.

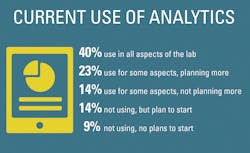

The good news continues regarding the usage of analytics to support lab operation and management. Survey statistics evidenced an overall industry openness to its use with 40 percent of respondents indicating analytics usage is already in place for some aspects of their jobs with plans for more. Another 37 percent also admitted using analytics with 14 percent of these respondents revealing they are not planning any additional usage. An added 14 percent said they have not started using analytics in their lab, but they would like to start. The last 9 percent of respondents reported they are not using data analytics for lab management, nor do they want to start in the near future.

One survey question that may cause concern was if respondents have tools to strategize product pricing, market share, maximize profit, etc. Only 31 percent said they have the tools to effectively manage their business, while 34 percent admitted they do not have the tools they need, but are interested in them. A disheartening 17 percent revealed they do have the tools they need, but they have not yielded the desired results, and the remaining 18 percent noted that the tools are not applicable to their business, and/or they do not see the value of these capabilities.

Future IT usage and challenges to overcome

In addition to the survey asking respondents about IT usage or lack thereof, as well as the status of their budgets, it also gave respondents a chance to divulge their lab wish lists, beginning with the areas they would like to see their labs expand in the future. The most popular answer – chosen by 42 percent of respondents – was chronic disease state monitoring. Answers that followed in order of popularity were scalable tools to expand molecular diagnostics (MDx), next-generation sequencing (NGS) testing, enterprise master patient index (EMPI) solutions, anatomic pathology testing and genetic analysis services.

Representing the answers of 14 percent of respondents, the “other” write-in option included wish list items such as better day-to-day lab management, better equipment, workflow and integration, emerging infectious disease testing, more staff, more space, more outreach tools, EMR integration, more interfacing between hospitals, increased efficiency, more wireless instrument interfaces, more IT support and new instrumentation to expand test menus.

When asked about their top strategic IT priority for their organization in the next three years, 38 percent of respondents said data analytics optimization to support lab management. This serves to remind us of the 91 percent of respondents who reported they are using or planning to use analytics in the future. Other answers in common among respondents were infrastructure and platform development (35 percent) and revenue cycle management (23 percent). The last 4 percent of respondents indicated that their top strategic IT priority over the next three years includes business intelligence, education, phlebotomy products and implementation of a new LIS.

Respondents were also asked to detail the challenges their organizations are currently facing or will face in the next three years in their planning and forecasting environment. As clear evidence of respondent budget concerns and lab demands, the most popular answers were funding, staffing and ROI/costs.

Conclusion – IT solutions are here to stay

Like many areas of medicine, the clinical lab is constantly changing, with products and technology intended to benefit and improve all aspects of patient care. As patients move through the cycle of care with physicians and specialists, the role of the clinical lab is arguably the most important part of a patient’s treatment team. However, as clinicians continue to rely on the clinical lab for test results that help create treatment plans, the medical industry will need to provide the funding and staffing necessary to meet growing demands for diagnosis, disease and data management.

As clinical labs attempt to keep pace with testing and data management needs that show no sign of decline, administrations will be faced with finding new sources of revenue that allow labs to integrate solutions that focus on efficiency and productivity, such as IT software and automated systems. Trends in clinical labs prove it is only through forward-thinking options and lab industry professionals that these labs will be able to overcome the challenges that exist today, as well as meet any that appear in the future.